Training Connecticut Teachers for New Personal Finance Requirement

By CEE

This article originally appeared in the Stamford Advocate.

STAMFORD — Teaching personal finance to high school students comes with plenty of challenges.

“I find it difficult because kids are coming to the class with certain values and you don’t want to disrupt the family values,” said Theresa Fischer, an adjunct professor of economics at Manhattanville College in Purchase, N.Y. and Iona University in New Rochelle, N.Y.

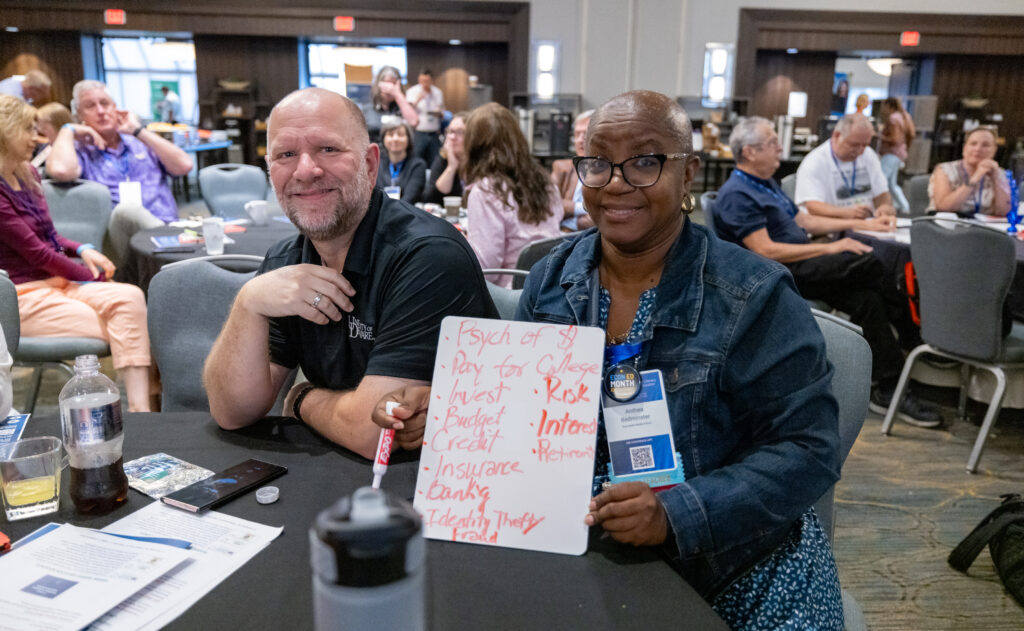

On Friday, Fischer asked a class of eight high school teachers to name some of the challenges they’ve faced teaching finance to their students. The teachers were gathered at an all-day professional development workshop hosted by the New York-based Council for Economic Education at the University of Connecticut Stamford.

The workshop was the first of its kind in the state and was organized to help local educators prepare for the new state personal finance requirements for all graduating seniors, starting with the class of 2027.

The law requires students around the state to complete a half-credit course in financial literacy prior to graduation.

Brian A. Pounds/Hearst Connecticut Media

It’s still unclear how school districts will administer the course, as it could be offered through a variety of disciplines, such as economics, math, social studies, and others. However, everyone who attended the workshop agreed that adding personal finance to the list of student requirements is a good idea, albeit a challenge.

Teaching about stocks may not seem relevant to students from families who struggle to put food on the table, said Zeeshaan Arastu, a teacher of economics and world history at New Canaan High School.

“It’s also hard when you have a diverse group of kids in the classroom because, in addition to the values, you also have different financial situations,” Arastu said.

Other teachers in attendance agreed that teaching finance can be tricky.

“We don’t know a lot about what’s next so we’re trying to plan for what the institution wants to do in terms of offering this,” said Joel Nick, an economics teacher at Farmington High School. “We want more kids to be competent with personal finance. We think there’s big value in that.”

Mike Staffaroni, who teaches economics, civics and American history at New Canaan High School, said requiring financial literacy is a “great idea.”

“The financial world is becoming so much more complicated,” he said. “It is a fantastic and important idea that all students who graduate high school in Connecticut have some financial literacy background.”

Further, many students don’t get this sort of education elsewhere as many families do not discuss finances at home.

“It’s not something that is often brought up in families unless it’s a set discussion led by the parent,” Staffaroni said. “Talking about money is not a natural thing for many families.”

Stacia Connors, who teaches accounting, business and personal finance at Brookfield High School, said financial literacy courses for high school students can be beneficial for those students’ parents as well.

“The parents don’t really even understand personal finance,” she said, describing situations she has witnessed. “So, what happens is they’ll come to parent-teacher conferences and say, ‘My kid came home and taught me about this.’ So, the kids are actually going home and teaching their parents, which is fantastic.”

The workshop was offered at no charge and other such training sessions are in the works, said Erin Heald, senior manager of programs for CEE.

“We’re reaching out to help teachers who may be new to teaching this topic — or may not be confident managing their own personal finance — with training, lessons and curriculum so they can be effective and confident educators,” said Nan J. Morrison, CEE president and chief executive officer, in a press release. “Better prepared teachers today lead to students who can build fruitful financial lives tomorrow.” Fischer, who was the instructor of the Friday workshop, gave an example of how a family’s values can directly impact in-classroom instruction.

“I would have a student whose parents say, ‘Don’t buy anything on credit. You are never to buy anything on credit,’ ” she said. “Well, if you’re teaching credit cards, and you’re teaching interest rates, we’re having a problem here because they’re just going to turn off.”

Connors said she leads a project at her school in which she asks students to plan for their future by choosing a college or trade school to attend, joining the military or going straight to the workforce.

For the students who pick college, part of their homework is talking to their parents about how they’re going to pay for it. Sometimes, that can turn into a thorny subject.

“It becomes an uncomfortable situation for them with their parents because they’ll come back in and say ‘My parents aren’t paying for any of it,’” Connors said. “It puts them and the parents in this awkward spot.”

Connors said personal finance has been a requirement at Brookfield for about seven years now. She attended on Friday to see if the state requirements differed at all from what she’s been teaching and to learn “ways to change it up a bit” when it comes to curriculum.

For Michelle Parchesky, a math teacher at Stamford High School, the workshop was less about learning the new state requirement and more about discovering ways to implement personal finance curriculum into her classes for the benefit of her students, many of whom are recently arrived immigrants with little understanding of the English language.

“I’d like to do some personal finance with them this last quarter so they some fighting chance, especially when they go to work or want to find an apartment,” she said.

About the Council for Economic Education

The Council for Economic Education‘s (CEE’s) mission is to equip K–12 students with the tools and knowledge of personal finance and economics so that they can make better decisions for themselves, their families, and their communities, and learn to successfully navigate in our ever-changing economy. We carry out our mission in three ways. We advocate to require financial and economic education in every state. We provide training, tools and resources – online and live through over 180 affiliates nationwide – to more than 40,000 teachers annually who in turn bring the highest quality economics and personal finance instruction to over 4 million students. We deepen knowledge and introduce high school students to critical career capabilities through our national competitions and Invest in Girls program.

Media contact:

CEE: press@councilforeconed.org

The post Training Connecticut Teachers for New Personal Finance Requirement appeared first on Council for Economic Education.